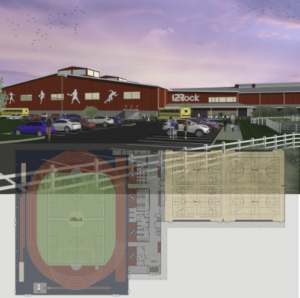

Sports Complex

HOW CAN YOU GET INVOLVED?

Would you consider a financial gift to help 12th Rock continue the mission to build a facility and run programming that provides life-lifting experiences for athletes, their families, and the communities we serve?

-

Donate Stocks or Mutual Funds | Giving Stocks/Mutual Funds allow you to potentially eliminate capital gains

-

Legacy Giving through Traditional IRA (ask your tax advisor)

-

Age 70 1/2- Required Minimum Distribution from your IRA (ask your tax advisor)

-

Prefer to write a check: 12th Rock | 440 Mt Hope Road, Middletown, NY 10940

-

EMPLOYER MATCH PROGRAM | Check with your company to see if they will match your donation

As a 501©3 non-profit organization, charitable giving to 12th Rock is tax-deductible. We provide tax receipts for donations.